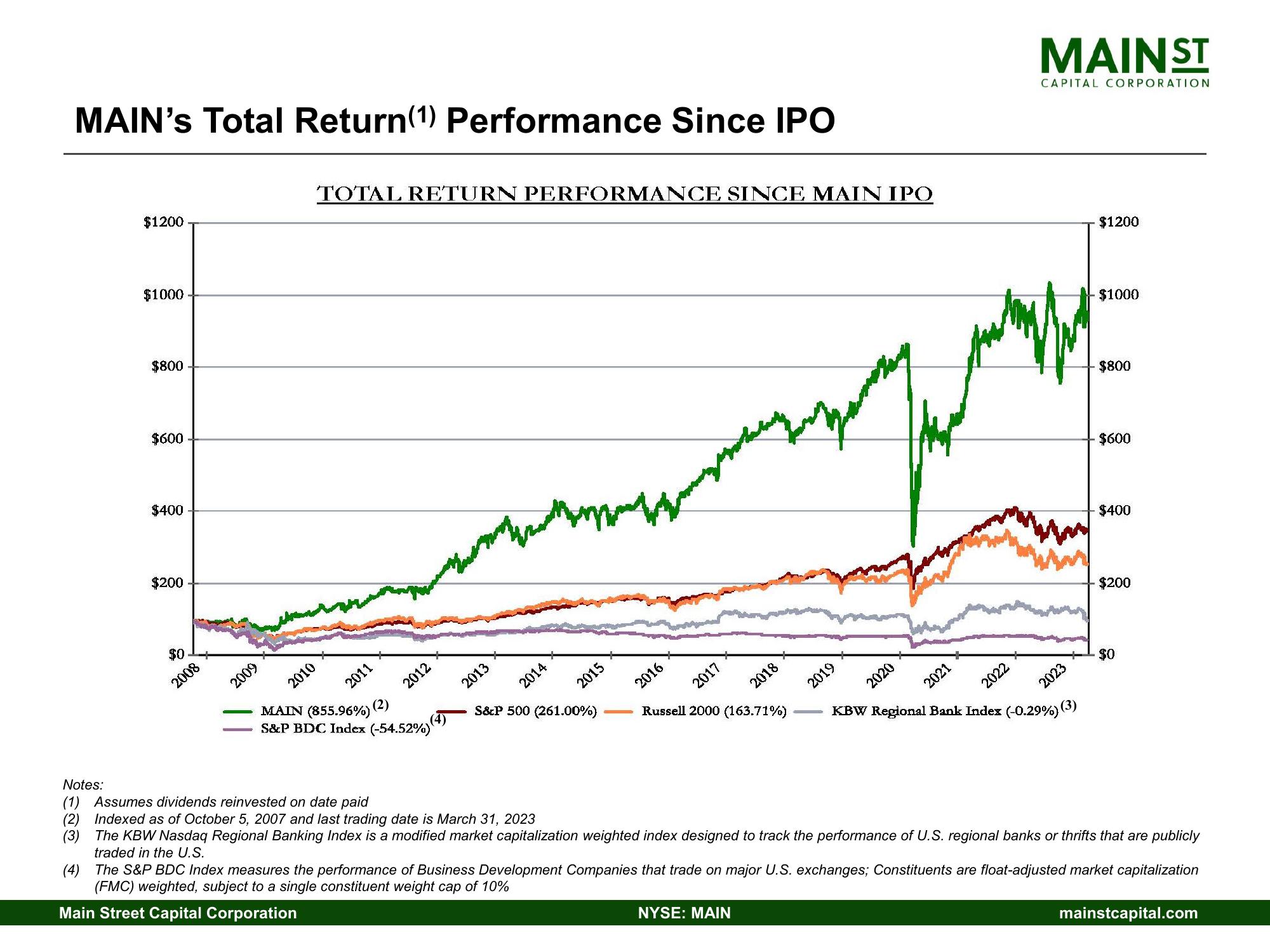

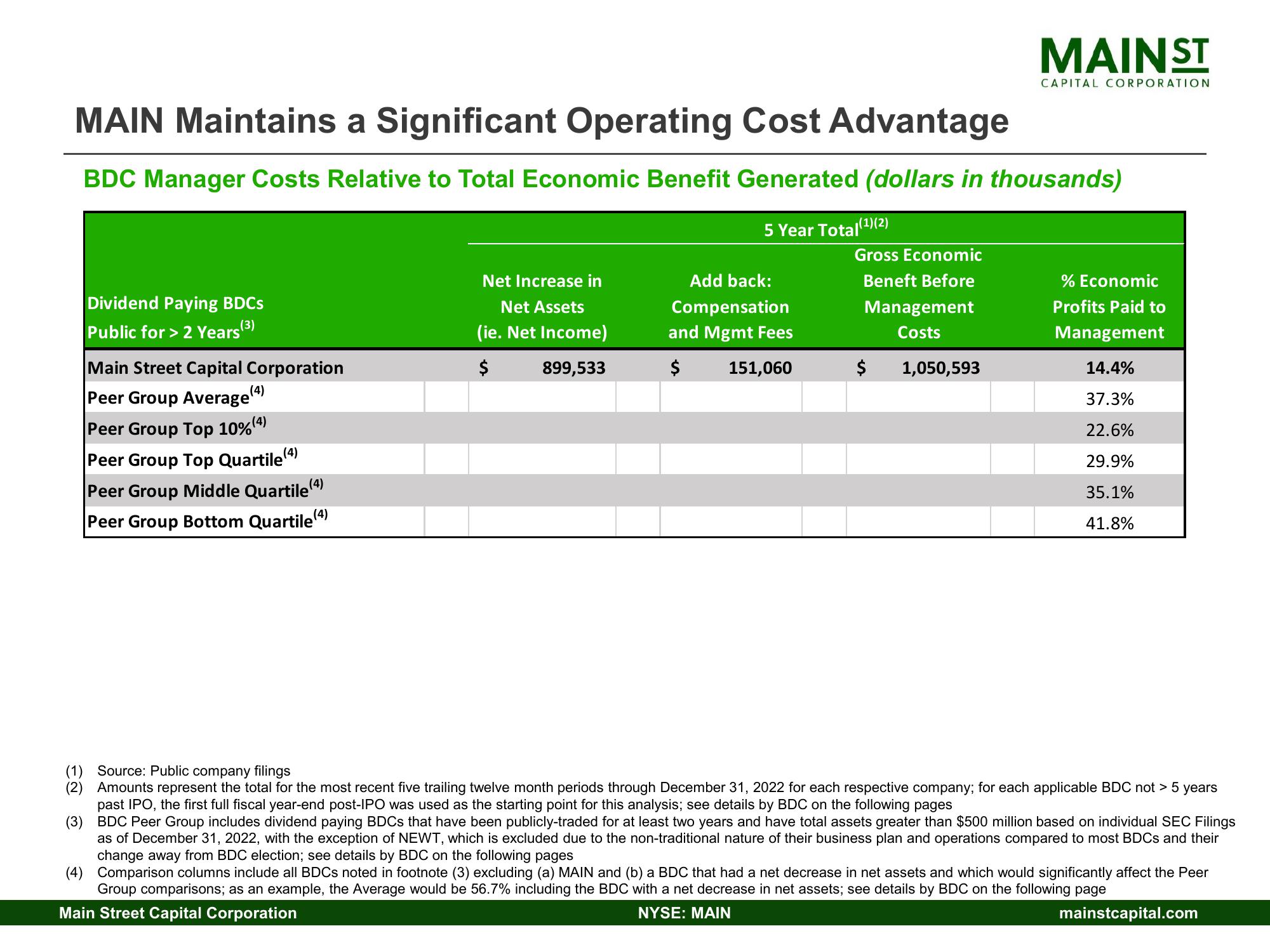

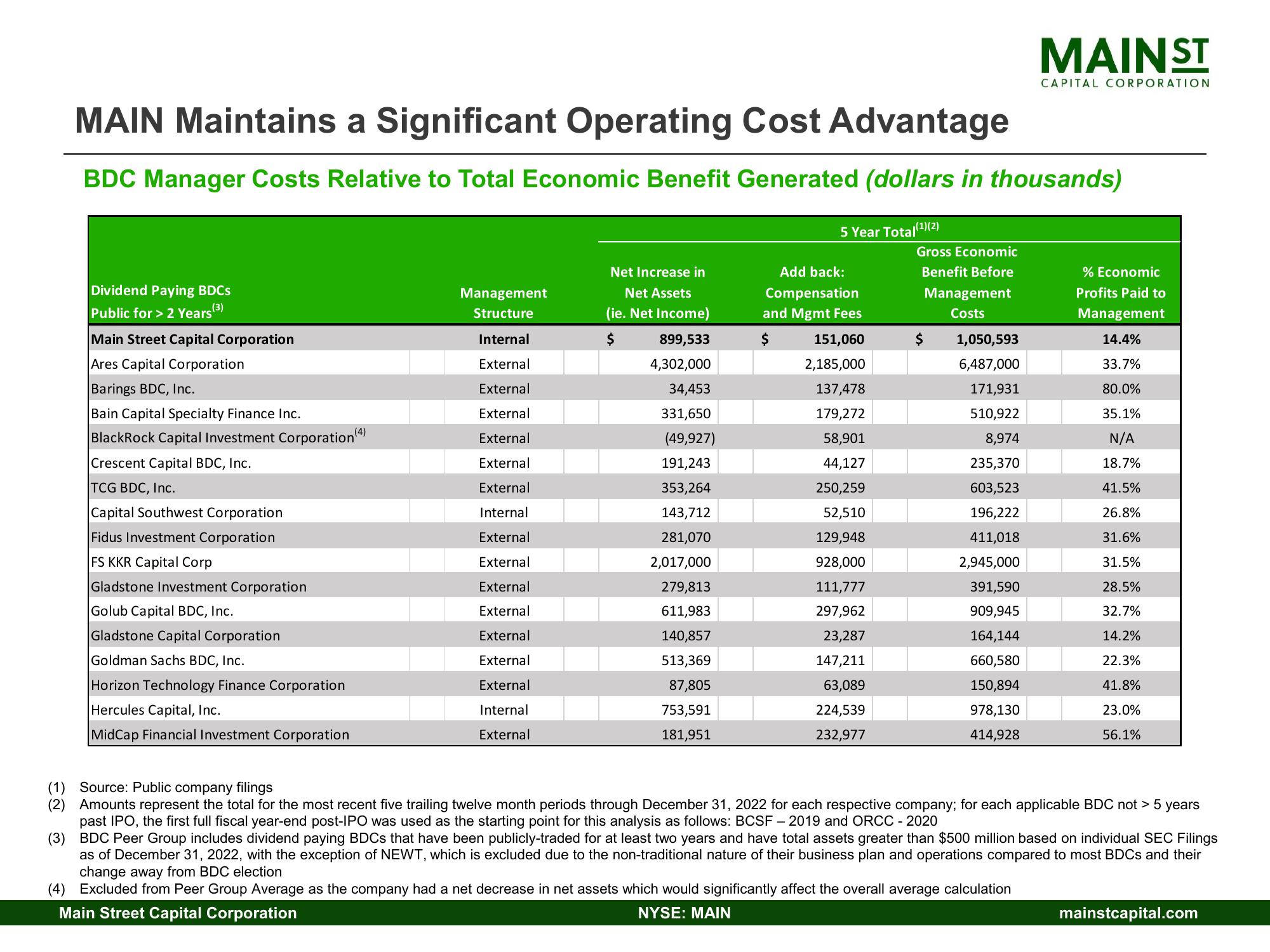

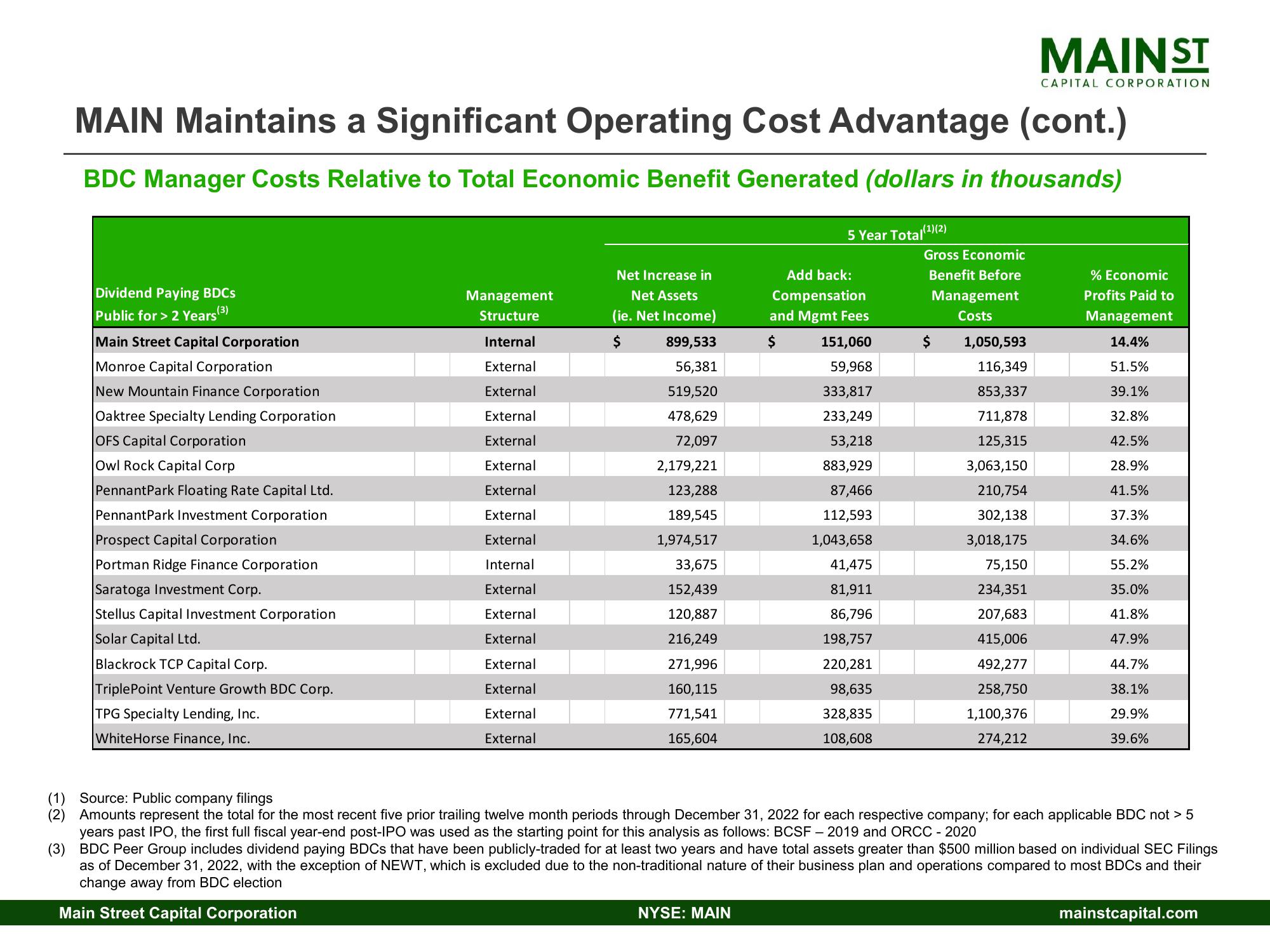

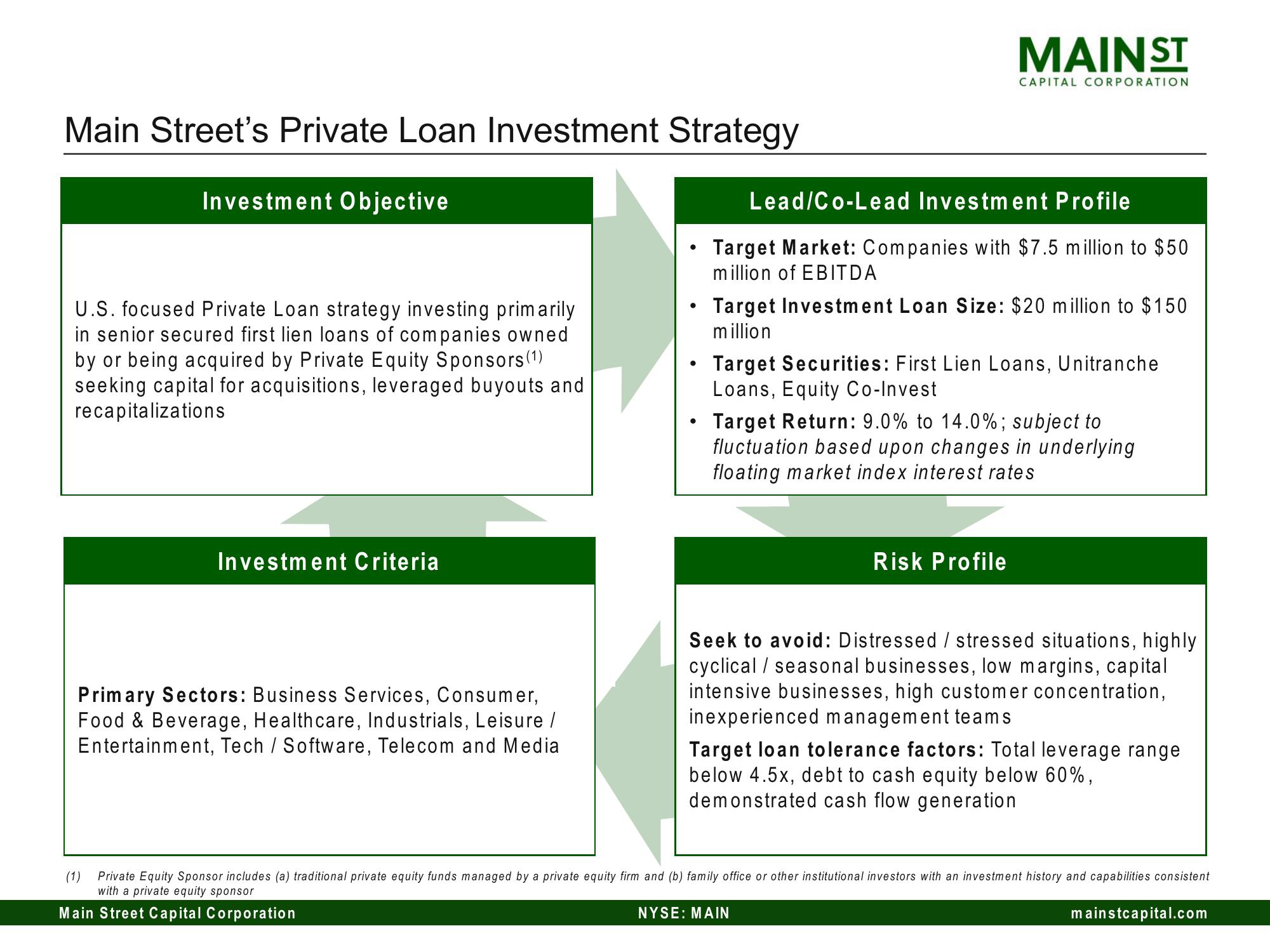

Main Street Capital Investor Day Presentation Deck

Released by

Main Street Capital

Creator

main-street-capital

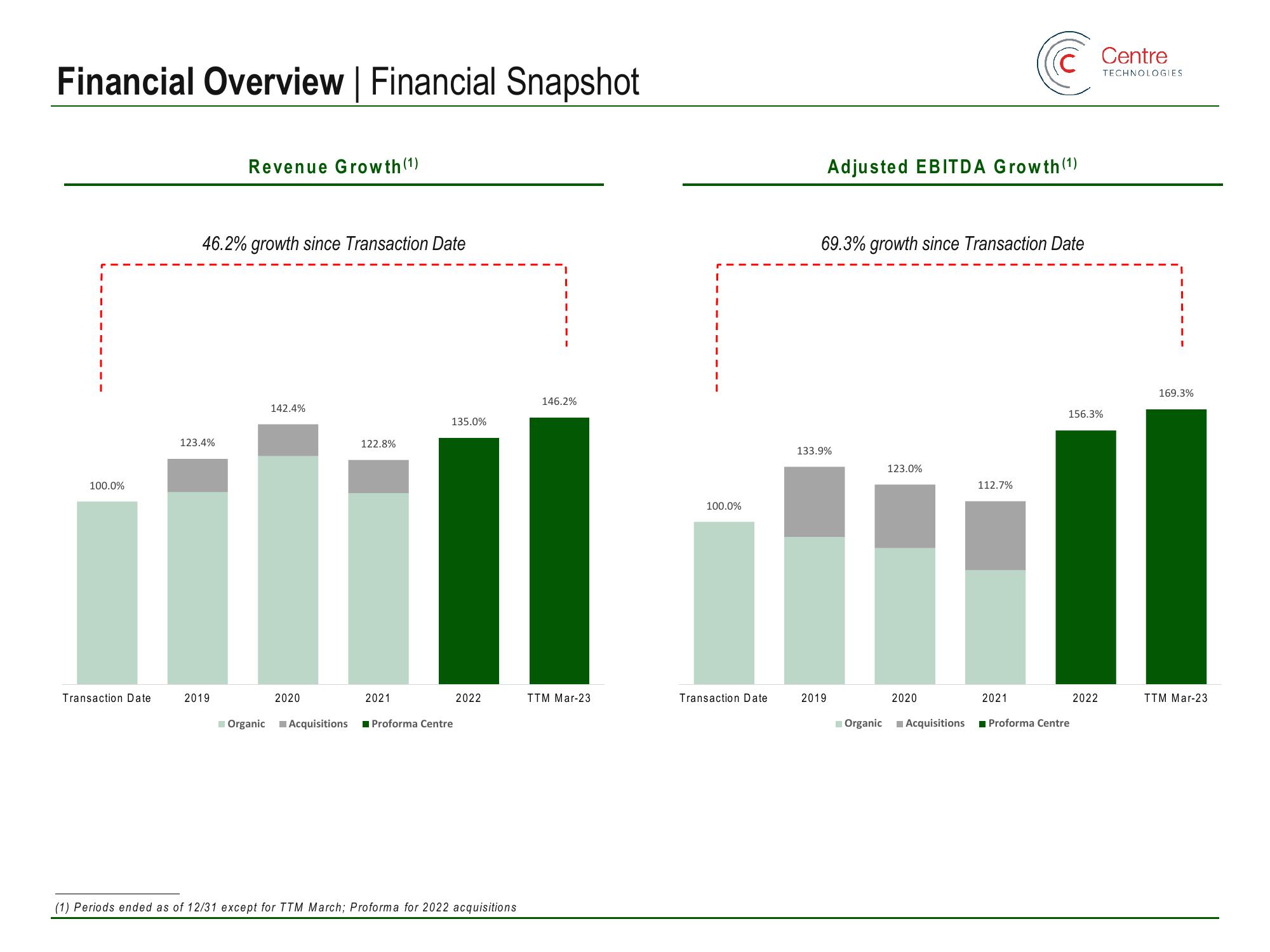

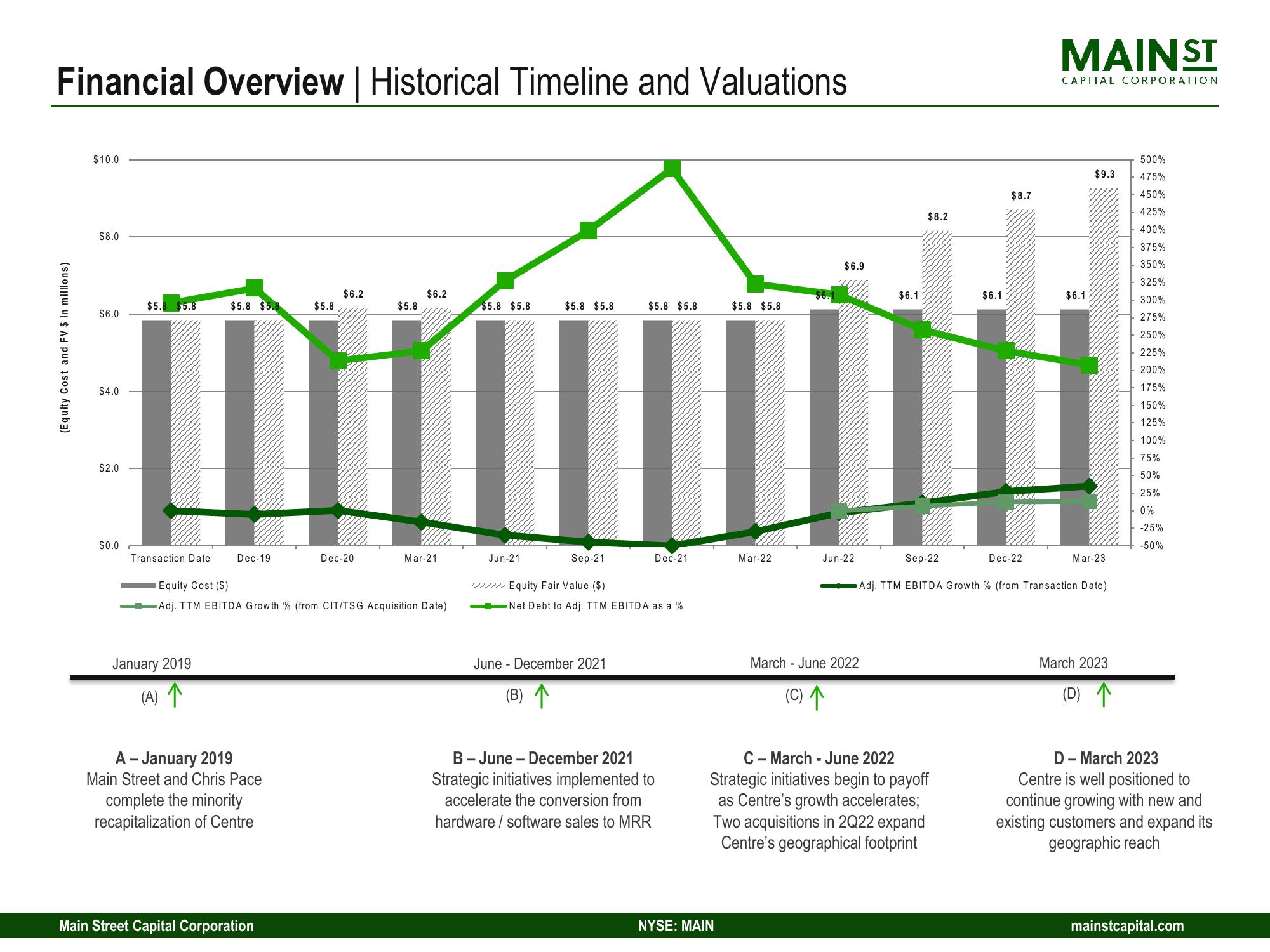

Category

Financial

Published

June 2023

Slides

Transcriptions

Download to PowerPoint

Download presentation as an editable powerpoint.

Related